The Power of Cost Segregation Methods in Financial Services

Cost segregation is a powerful tax planning strategy used in financial services to accelerate depreciation deductions and reduce tax liabilities for businesses. At Tax Accountant IDM, our team of expert accountants specializes in implementing cost segregation methods to optimize tax savings for our clients in various industries.

Understanding Cost Segregation Methods

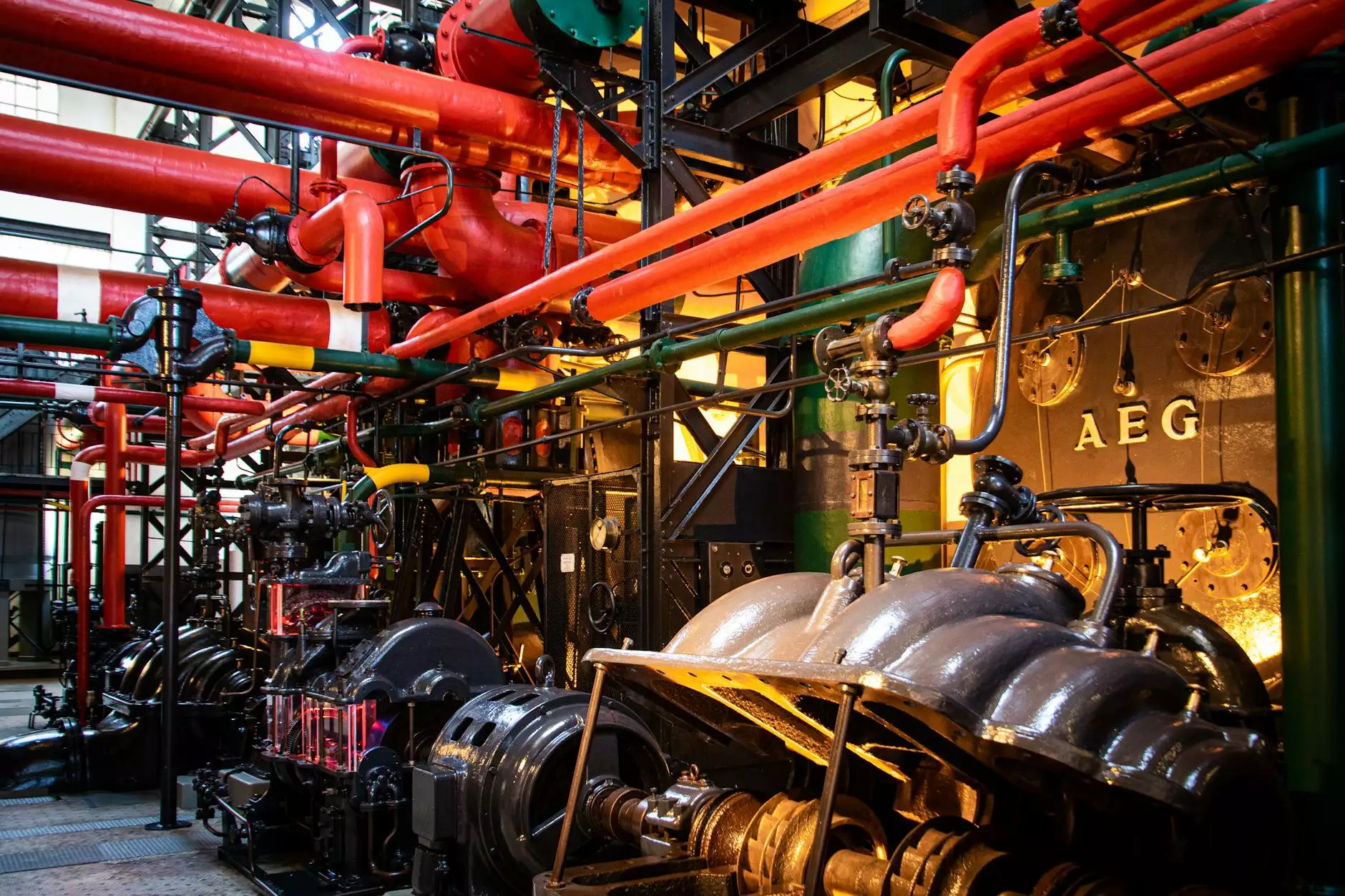

Cost segregation involves identifying specific building components that can be reclassified for accelerated depreciation purposes. By categorizing assets such as electrical systems, HVAC units, and interior finishes separately from the building structure, businesses can take advantage of shorter recovery periods and higher depreciation deductions.

Benefits for Businesses

Implementing cost segregation methods can result in significant financial benefits for businesses, including:

- Increased Cash Flow: By front-loading depreciation deductions, businesses can improve cash flow and reinvest in operations.

- Tax Savings: Accelerated depreciation leads to lower taxable income and reduced tax liabilities.

- Enhanced ROI: Maximizing depreciation deductions can improve return on investment for real estate assets.

Expert Tax Services at Tax Accountant IDM

At Tax Accountant IDM, we combine our expertise in financial services and tax planning to help businesses leverage cost segregation methods effectively. Our dedicated team of accountants works closely with clients to identify opportunities for tax savings and maximize deductions through strategic cost segregation.

Industry-Specific Solutions

Whether you operate in the real estate, hospitality, manufacturing, or healthcare industry, our tailored cost segregation services are designed to meet your unique business needs. We understand the complexities of different sectors and customize our approach to ensure maximum tax benefits for your organization.

Why Choose Tax Accountant IDM?

When it comes to optimizing tax savings through cost segregation methods, partnering with a reputable firm like Tax Accountant IDM can make all the difference. Here's why you should choose us for financial services, accountants, and tax services:

- Expertise: Our team consists of highly skilled accountants with extensive experience in cost segregation and tax planning.

- Personalized Approach: We take the time to understand your business goals and tailor our services to align with your objectives.

- Proven Results: We have a track record of helping businesses across industries achieve substantial tax savings through cost segregation methods.

- Commitment to Excellence: We are committed to delivering exceptional service and maximizing value for our clients.

Contact Tax Accountant IDM Today

If you're looking to optimize tax savings and enhance your financial strategy with cost segregation methods, don't hesitate to contact Tax Accountant IDM. Our team is ready to provide expert guidance and support to help your business thrive in today's competitive landscape.

Copyright © 2022 Tax Accountant IDM. All rights reserved.